Investing in the expansion of small grains, particularly oats, will create a three-legged stool that produces economic, agronomic, and environmental benefits for our farmers and state.

Investing in the expansion of small grains, particularly oats, will create a three-legged stool that produces economic, agronomic, and environmental benefits for our farmers and state.

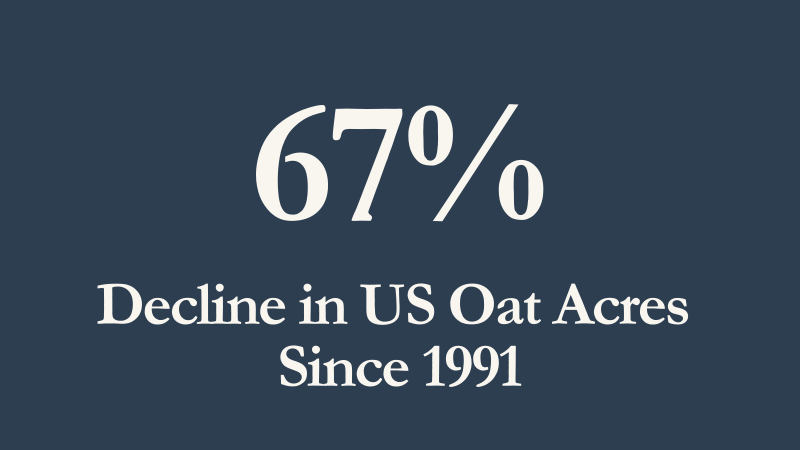

Over the past four decades, Midwestern small grain production has dropped steeply as corn and soybeans, benefiting from a commodity-centered policy environment, dominate ag acreage.

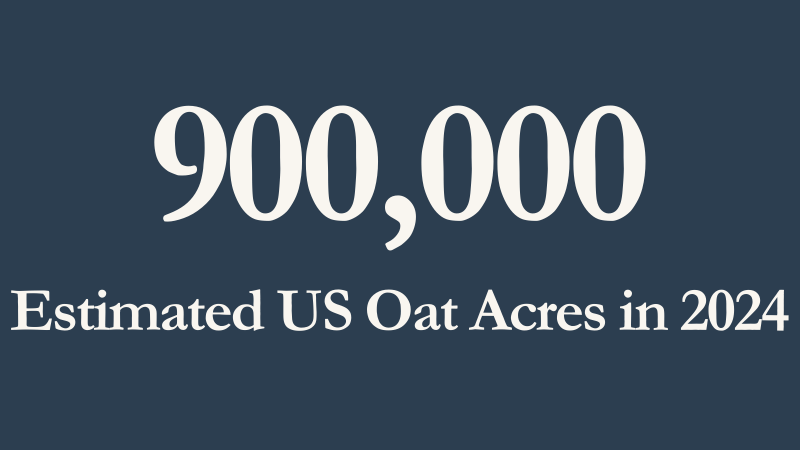

A case study of this issue may be seen in oats. In 2022, U.S. farmers produced oats on less than 900,000 acres. Meanwhile, Canada, which is now the world’s largest exporter of oats, grew 3.9 million acres of the grain that same year. The U.S. is now the world’s largest importer of this grain.

The time to act on this opportunity is now: with growing demand from the food industry and a strategic opportunity to position Minnesota as a leader in sustainable agriculture, this investment will generate long-term economic growth while protecting our natural resources.

Contact LSP’s Soil Health team for more info:

Alex Romano

Soil Health Team Manager

aromano@landstewardshipproject.org

Phone: 641-220-6000

Shea-Lynn Ramthun

Soil Health Organizer

slramthun@landstewardshipproject.org

Phone: 651-301-1897

Sarah Wescott

Soil Health Organizer

swescott@landstewardshipproject.org

Phone: 612-767-9881

Alex Kiminski

Soil Health/Land Access Organizer

akiminski@landstewardshipproject.org

Phone: 320-269-2105